Blog

22nd July 2020

Fertilizer is an artificial substance containing chemical elements that improve plant growth and productivity. Fertilizers enhance the natural soil fertility or replace chemical content taken by previous crops from the soil. Nitrogen, Phosphorus, and potassium are the principal nutrients present in the commercial fertilizers. Other products include manure and micronutrients (include iron, manganese, zinc, boron, molybdenum, and copper) are added in smaller amounts.

World consumption of these three primary fertilizer nutrients, nitrogen ( N), Phosphorus expressed as phosphate (P2O5), and potassium represented as potash (K2O), is predicted to reach 200.92 million tons (N, P2O5, and K2O) in 2022. The estimated annual demand for N, P2O5, and K2O is set to increase from 2019 to 2022. Global output potential for fertilizers, intermediates, and raw materials is also set to rise in the next four years.

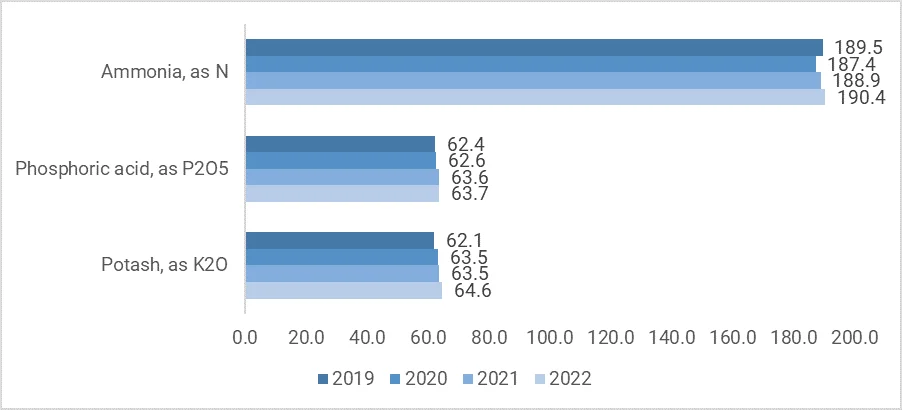

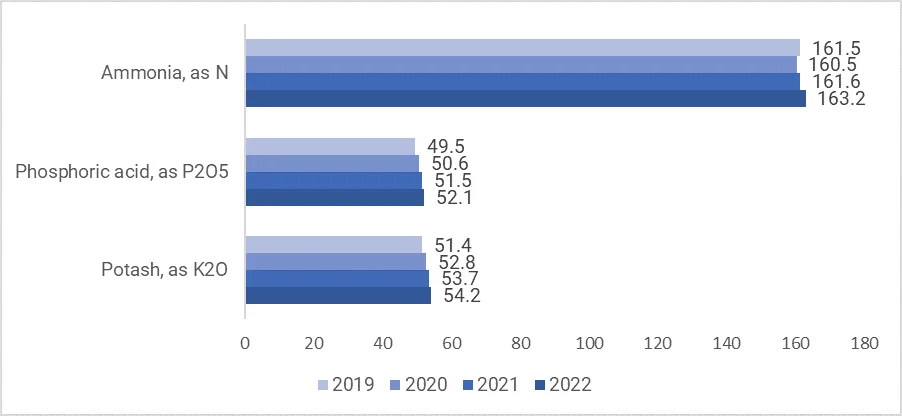

The global nutrient capacity (N, P2O5, and K2O) was 313.96 million tons in 2019, out of which the total supply was 262.39 million tons. Over the next four years, Global capacity and fertilizer production are expected to increase further through 2022. The estimated supply of ammonium (NH3), phosphoric acid (H3PO4), and potash between 2019 and 2022 globally are as follows:

Global Nutrient Capacity of Ammonia, Phosphoric Acid, and Potash, in million tonnes, 2019-2022

Source: Food and Agriculture Organization

Source: Food and Agriculture Organization

Global Supply of Ammonia, Phosphoric Acid, and Potash, in million tonnes, 2019-2022

Source: Food and Agriculture Organization

Source: Food and Agriculture Organization

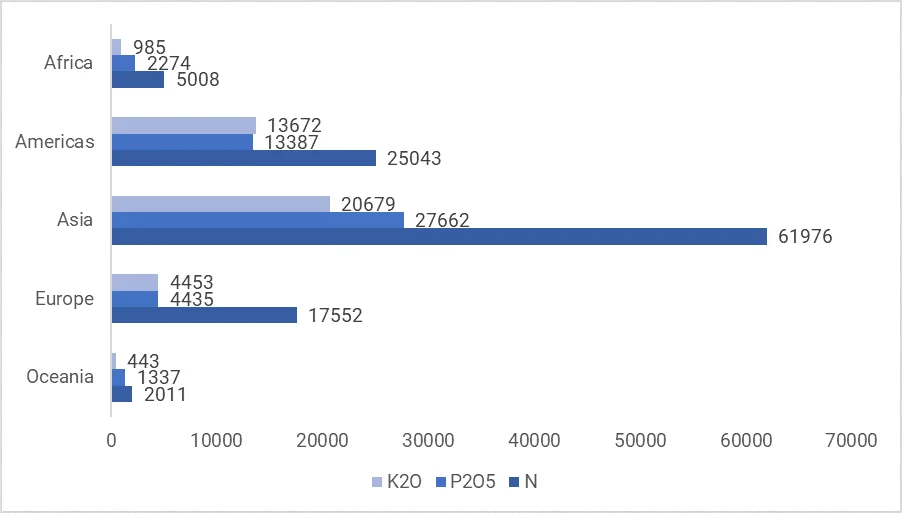

Regional Fertilizer demand by 2022:

Global Fertilizer Demand, by Nutrient, in thousand tonnes, 2022

Source: Food and Agriculture Organization

Source: Food and Agriculture Organization

Currently, the Asia-Pacific region is the major consuming region for fertilizers owing to the presence of large agriculture industry and a high density of population in the region. The growth of the fertilizers is anticipated to be driven by the growth in the micronutrients based fertilizers during the forecast period. In addition to this, the growth in the production of fertilizers is also expected to drive the market growth.

It is estimated that between 2018-2023, the fertilizer industry would invest around USD 110 billion in constructing about 70 production units enhancing the current capacity. Among these, nitrogen capacity is likely to account for two-thirds of total investments.

In many regions, at regional, national, and sub-national levels, the fertilizer industry is implementing new supply-related regulations. Respective policymakers are planning to adopt new regulations on product and plant certifications and tailing management owing to the environmental and safety considerations. The ongoing trade sanctions are also expected to restraint market growth globally. It has been witnessed in recent years, that the pace of trade liberalization has slowed down with an increase in restrictive measures.

The overall demand for fertilizers through 2022 is expected to grow at a CAGR of about 1.3%.

Detailed analysis of the Impact of Covid-19 on Agrochemicals Market will be available in our Full Report.