Blog

09th July 2020

The chemical industry is crucial for the economic development of any nation, providing products, and allowing technical solutions in virtually all segments of the economy. India is the sixth-largest producer of chemicals globally, and the third-largest producer in Asia in terms of output as the chemicals sector holds a significant position in the Indian economy, accounting for 7% of the GDP and about 14% in the overall index of industrial production (IIP). Chemicals industry in India is diversified, covering more than 80,000 commercial products.

The Indian Agro-Chemicals market is worth 2.5 Billion USD holding second place globally, accounting for 7.7% of global agricultural output. India is the third-largest consumer of polymer and the fourth-largest producer of agrochemicals in the world. There is a massive opportunity for the Indian market to grow fast due to a large population and a strong export demand. Moreover, the per capita consumption of chemicals is lower in India compared to western countries, therefore presenting immense scope for new investments.

For instance, Reliance Industries Ltd (RIL) is pursuing the deal with Saudi Aramco under which the Saudi Arabia energy giant is likely to pick up a 20 percent stake in RIL's oil-to-chemicals business for 15 Billion USD based on an enterprise valuation of 75 Billion USD. This lead several foreign investors like Mitsubishi Chemicals Corporation (Japan), Akzo Nobel (Netherlands), DuPont (USA), Syngenta (Switzerland), Croda (UK), DyStar (Germany) and Henkel (Germany) to enter Indian chemical industries. However, inadequate infrastructure facilities, power shortage, and reduced availability of quality catalysts are likely to act as restraints for the Indian chemical market.

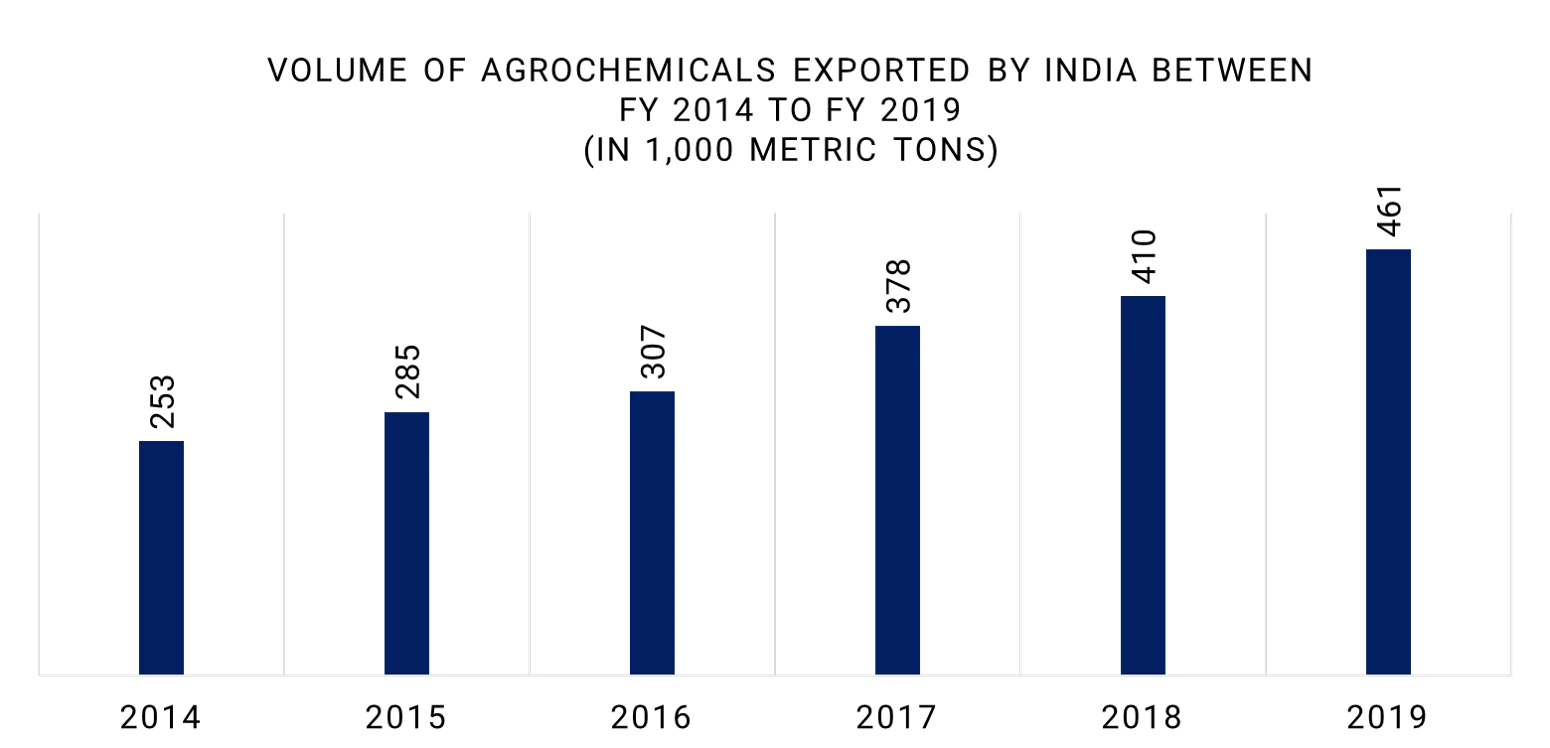

Source: Directorate General of Commercial Intelligence and Statistics

India accounts for approximately 16% of the world dyestuff and dye intermediates production, making it a reliable dye supplier globally constituting near about 5.4% of India's total exports. For instance, The Department of Chemicals and Petrochemicals (GoI) announced that the entire commodity for chemicals stood at USD 19.09 billion during the year 2018-19 which dominated mainly by MSMEs, contributes nearly 10.5% to India's foreign trade and is an employment generator for millions generating an annual growth rate of about 8-10%. The sector is estimated to double its size to USD 300 billion by 2025. To attain this, the Government is pursuing a draft chemical policy that will focus on meeting the rising demand for chemicals and reduce imports.

This is part of our Petrochemical Intelligence Hub. For more details about the service, please get in touch here.