Blog

16th July 2020

Plastics along with specially formulated polymer compounds, make possible a wide range of elements used in medical device design ranging from blood-pressure cuffs to catheters and syringe bulbs and bags for intravenous (IV) fluids. Medical tubing includes peristaltic tubing that pump fluids and multi-lumen catheters that can be used to administer multiple intravenous solutions or drugs at once. Medical equipment including Yankauer suctioning tools, oxygen masks, and drip chambers is essential for several surgeries. The other applications of medical plastics include gaskets, insulation, cushioning, bag spouts, caps, and fittings.

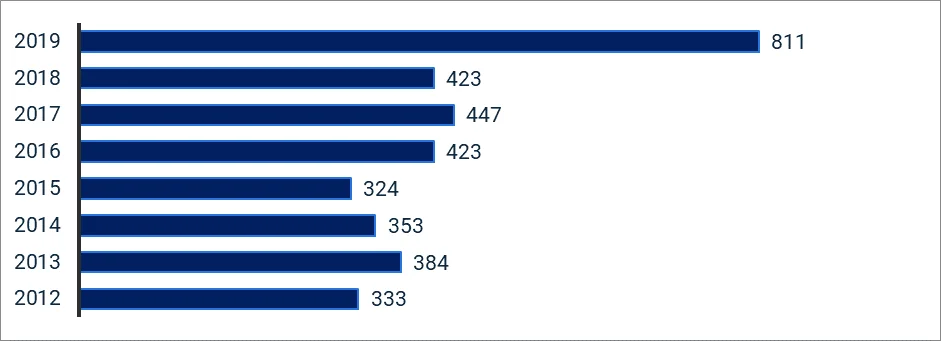

The most common thermoplastic materials used in medical equipment manufacturing include polyvinyl chloride, polycarbonate, polyethylene, polypropylene, and some custom polymers for specific applications. With the developments in medical technology, the consumption of these polymers is expected to increase in the coming years. In 2019, about 14,000 patent applications were filed with the European Patent Office (EPO) in the field of medical technology, a growth of 0.9% compared to the previous year.

Modern medicine depends on an array of plastic-based medical equipment used in general practices. The high acceptance afforded global medical technologies is a clear indicator of the industry's innovative strength exemplified by above-average expenditure levels. But it is not just in standard medical practices that polymers make their presence felt; plastics increasingly manufacture state-of-the-art orthopedic prostheses and even artificial organs. Polymers are also being used in the extensive wounds to reduce skin graft levels. Moreover, increased incidences of chronic diseases, changing lifestyles of the middle-income group, demand for better healthcare facilities, including equipment, and an increase in the aging population are the major drivers for the market. However, the depletion of petroleum reserves and fluctuating crude oil prices are likely to act as restraints to market growth.

Inventory volume of rubber products for medical and surgical dressings in Japan from 2012 to 2019 (in tons) *

Source: METI (Japan)

Polyether ether ketone (PEEK) has been used to put back metal as a hip stem component. As a metal replacement, the ketone polymers match the flexibility of the native bone, especially when compared to titanium or steel hip replacement stems. PEEK polymers were first introduced due to their high heat resistance and remarkable inertness, making them an ideal component for applications that involve contact with tissue and blood. These properties make them the most significant material for long-term orthopedic implant applications such as bone screws, plates and pins, tissue anchors, and suture screws. However, the limited availability and high costs are likely to hinder the market growth to some extent.

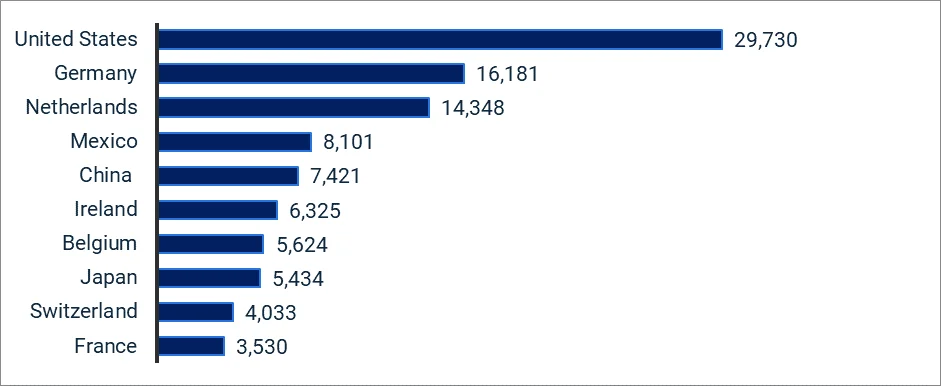

Top 10 Medical Devices Exporting Countries, in USD million, Global, 2019

Source: Trademap

Globally, the United States accounted for about 42% of the medical device market followed by Europe and the Rest of the world with 28% and 30% shares respectively. Asia-Pacific is projected to be the most significant medical plastics market during the forecast period due to increasing industrial and urbanization growth. Also, this region has immense growth potential driven by the increasing demand for a better healthcare system. Asia-Pacific consists of some large and rapidly growing economies, such as China, India, Indonesia, Malaysia, Thailand, and Vietnam. Across these economies, local governments are reforming rules and regulations in the healthcare industry to raise the efficiency and efficacy of medical equipment and related healthcare services. Hand-held/portable diagnostic equipment (e.g., blood pressure testing, blood sugar, etc.) is also a developing segment since India has around 60 million diabetics, which is expected to swell to 90 million by 2025. The significant drivers for the medical device sector in Asia-Pacific are changing awareness regarding value-based care in existing systems, partnerships across value-chain, increasing R&D, and digitalization of the healthcare system.

The future of medical equipment is likely to be optimistic due to the continuous rise in the demand for better healthcare systems. In addition to this, the ongoing COVID-19 pandemic is also expected to drive the governments to invest in healthcare systems to control the spread of the virus. WHO warns of a global shortage of medical equipment to fight COVID-19 all across the globe unveiling USD 12 billion aid. The increasing demand for quality healthcare and the absence of matching delivery mechanisms pose a challenge and, indeed, a great opportunity.